Cost of Capital: Cash vs. Debt vs. Equity

Capital is the lifeblood of business.

Capital is absolutely crucial when it comes to running and scaling a business. But what really is it?

What is Capital?

Essentially, capital is the money or wealth needed to produce goods and services within your business. In the most fundamental terms, it is money.

Capital is a type of resource which, when combined with other resources, helps business owners create value for their customers and for society.

For example, capital can be combined with labor, the work of individuals who exchange their time and skills for money, to create value in the marketplace in the form of goods and services.

Business people refer to capital as lifeblood because it is used to support all kinds of operations within a company. It is utilized for the payment of rent, payroll, and other operating costs.

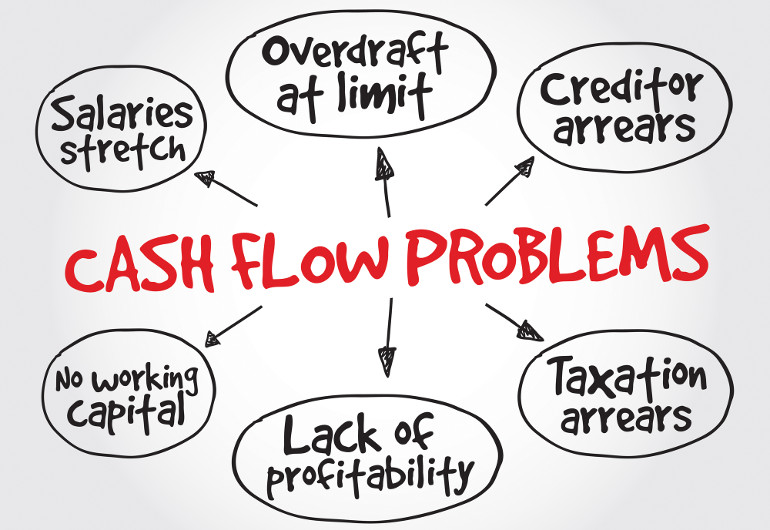

Scarcity of capital can put your business in a very risky situation, so you need to monitor your cashflow very carefully.

Remember this: Businesses get bankrupt because they run out of money, not because they don’t generate sales.

Want to get my eBook "From Employee to Online Entrepreneur" as a nice PDF? Download it below!

Sources of Capital

Most business books and articles mention that business capital comes in two main forms: debt (“loanership”) and equity (“ownership”).

I personally like to add a third one in the mix: Cash.

I will elaborate on those later in this article, but let’s briefly discuss each one of them.

A business can acquire capital by assuming debt. Debt capital can originate from financial institutions (e.g. banks) and insurance companies, or through public sources, such as federal loan programs.

Large companies may also issue bonds which is a specific type of debt.

Equity capital refers to invested money that is not repaid to the investors in the normal course of business. It represents capital that the owners have at stake through the purchase of a company’s shares.

Essentially, raising capital via equity means that the company is “selling” part of itself to investors.

There are a few key differences between debt and equity capital.

First of all, debt (i.e. loans and other types of credit) has to be repaid in the future, usually with interest. Now, that is actually more serious that it sounds.

Assuming debt means that you are obliged by law to pay it back. Failing to repay debt means that your business might go bankrupt.

For this reason, debt can be risky and must be used with extreme caution and prudence.

On the other hand, equity generally does not involve a direct obligation to repay funds to investors. Instead, they receive an ownership position in the company via the form of stock.

In essence, raising equity capital means that you are giving part of your company to the investors that invest in it.

Again, this can also be risky since you are “losing” part of your business. The end goal here is to raise money so that you can create a larger “pie” of which you are going to have a smaller piece of.

Now, as I mentioned, I like to include a third option that is more applicable to starting entrepreneurs. That option is Cash.

By Cash, I mean any funds that the business owner might contribute to the business to get it started and gradually grow it.

Initially, that money might come from his or hers own savings, or even from friends and family, but in the form of “grant” (i.e. the entrepreneur is not obliged to pay it back).

More importantly, Cash can also be generated by the company’s own operations.

Put simply, the business provides products or services to its customers, who then reward it with their own hard-earned money in the form of revenue.

This is the optimum resource of capital and the businesses that are able to generate healthy levels of cashflow are the most valuable ones.

Having briefly discussed the various sources of capital, note that the optimal capital structure is the one that strikes a balance between risk and return for both the business and its investors.

Cost of Capital

As I mentioned, capital is a necessary factor of production and, like any other factor, it has a cost attached to it.

What that means is, that a business, in order to obtain capital, it will have to pay for it in some form.

In the case of debt capital, the associated cost is the interest rate that the business must pay in order to borrow money.

In the case of equity capital, the associated cost is the returns that must be paid to investors in the form of dividends and capital gains.

In general, the cost of capital for small businesses tends to be higher than it is for large, established businesses.

This makes sense because smaller business are inherently more risky, and given the higher risk involved, both debt and equity providers have to charge a higher price for their funds, in order to achieve a more balanced risk/reward outcome.

As a result, a smaller, more risky business will have to cope with a higher interest rate than a larger one. At the same time, if it was to offer equity, the investors would need a larger piece of the “pie” in order to achieve greater returns in the future.

So, having discussed debt and equity capital, let’s talk about Cash. Does Cash have some cost associated with it?

Surprisingly, the answer is yes!

That cost comes in the form of Opportunity Cost, which includes all the benefits we could have received by taking an alternative action with that Cash.

As an example, using Cash to grow your business means that you are not able to allocate those funds to the stock market or a real estate deal.

Let’s elaborate a bit on each option.

Cash as Capital

Starting out, using Cash as capital is the healthiest option for your business.

If you have accumulated some savings that you can then plow into your business, it means that you are in a position to venture out without depending on outsiders and without selling out a piece of your company.

In the vast majority of the cases, entrepreneurs should avoid raising debt or equity capital and strive to leverage only their own funds.

This is what Bootstrapping a business is all about.

You start with a business idea, you use some cash of yours and tons of “sweat equity” (i.e. your own labor and skills), you quickly get some customers for your products or services, you generate revenue by selling to them and you reinvest that money into the business to further grow it.

It is a great positive feedback loop and a wonderful thing to see.

As a company grows and achieves higher levels of revenue, it is natural to retain a portion of its earnings as Cash on its balance sheet.

Maintaining a healthy level of Cash is always prudent. It allows a company to withstand market downturns, and also to act on various opportunities that might rise from time to time.

Overall, Cash is the cheapest option when it comes to capital, and should be the first choice of most starting entrepreneurs.

Debt Capital

Raising debt is another popular option, especially for more mature companies that usually also have some hard assets (like plants, cars, equipment etc.).

Banks will rarely lend businesses that are not yet proven unless they have to offer some kind of collateral, for example a building that the company owns etc.

For this reason, entrepreneurs that build online businesses might find it harder to raise debt capital since they are “asset light” businesses.

As I said, assuming debt can be very risky, and you should do it only when you know what you are doing.

Ideally, debt should be infused into a company when it has built a sustainable and scalable business model, where the extra capital will work as fuel to take its revenues to the next level.

You need to be certain that the incremental cost of debt capital (i.e. the interest) will be largely surpassed by the extra returns that the business will generate. Otherwise, you will be essentially losing money at scale!

Business debt is not always bad as its cousin, consumer debt. Under the right circumstances, it can be used to supercharge returns for a well-oiled business that is run by an owner that knows what he is doing.

Equity Capital

Raising equity capital means that you are giving up part of ownership in your own company. Selling a piece of your business means that it is never going to be the same again.

As with debt capital, you should also take equity capital very seriously. Raising equity only for the monetary resources is dumb. The investors that invest in your company should not only bring their money, but other resources as well (e.g. connections, expertise etc.).

The best case for equity capital is when you are confident that the new co-owners are going to help you build a much larger and more valuable company than the one you would build on your own.

Would you rather own 10% of the juggernaut company that listens to the name Facebook, or 100% of a small unknown company?

The answer is clear but the tricky part is that outcomes like the one of Facebook’s are very, very, very rare.

In any case, equity capital has its place in the business world and can generate great results for the business owner that understands its implications.

Based on the analysis above, we can see that, with only a few exceptions, the most expensive source of capital is Equity, followed by Debt, followed by Cash.

Conclusion

Capital is considered the lifeblood of a business and for good reason.

Capital not only allows a company to operate smoothly and efficiently, and it can also be leveraged to grow it to extraordinary proportions.

However, since capital comes with an associated cost, you should be extra careful when and how you are sourcing it.

We discussed three sources of capital, namely Cash, Debt and Equity. Each one has its place in the lifecycle of your business and you might employ some or all of them in order to grow and scale your company.

Closing, I will leave you with a quote from one of the greatest entrepreneurs this world has seen:

“Capital isn’t scarce; vision is.”

– Sam Walton