What is Business Efficiency and Why it is a Matter of Life and Death for your Company

One of the most underappreciated concepts in business is that of business efficiency.

In general, efficiency refers to the extent to which input towards a system is well used for an intended output. If you think in terms of a machine, you want to achieve the highest amount of output (e.g. produced goods) with the lowest amount of input (e.g. energy, labor etc.).

What is Business Efficiency?

In business, efficiency refers to the production of goods or the offering of services by using the smallest amount or resources, like capital, labor force, energy consumption etc.

Efficient businesses are able to create products, offer services and accomplish their overall goals with the minimum effort, expense or waste.

Taking this one step further, and since the ultimate output of a business is revenue generation, “business efficiency” refers to the amount of money (revenue or profit) a business is able to generate with a given input of resources.

Since resources are finite and costly, our end goal as business owners is to build companies that are efficient and generate the maximum revenue for their given input.

Achieving that allows us to allocate more resources to research and development, reinvest in the business’s infrastructure, spend more on marketing and sales, or increase profit margins.

On the other hand, an inefficient business is going to “waste” resources, thus limiting its ability to grow, and is in danger of being crushed by its more efficient competitors.

Since a business is a very complex system, increasing its efficiency depends on both increasing the efficiency of the various submodules (e.g. marketing, customer service etc.) and the interaction among them (e.g. collaboration between marketing and sales).

Want to get my eBook "From Employee to Online Entrepreneur" as a nice PDF? Download it below!

Comparison of Different Businesses

When comparing the efficiency of businesses, it is important to do it within the context of a given industry. It does not make sense, for example, to compare a manufacturing company with an online business, or even a clothing retailer to a bakery chain.

To compare the efficiency of different businesses, a good metric to use is that of Profit Margin (Gross Profit and/or Operating Profit).

In general, profit margin is expressed as a percentage and measures how much out of every dollar of sales a company actually keeps in earnings. More specifically:

Gross profit margin is a financial metric that reveals the proportion of money left over from revenues after accounting for the cost of goods sold (COGS).

Operating margin is a measurement of what proportion of a company’s revenue is left over after paying for variable costs of production such as wages, raw materials, etc.

In that sense, profit margins effectively measure the “financial health” of a business, and the efficacy of its business model.

Another class of useful metrics are the various Financial Ratios that calculate the “Return on Investment”.

For example, the Return on Assets (ROA) ratio (calculated by Net Income divided by Assets) measures how efficiently and effectively a company is leveraging its Assets.

Similarly, the Return on Equity (ROE) ratio (calculated by Net Income divided by Equity) measures how efficiently and effectively a company is leveraging its total equity.

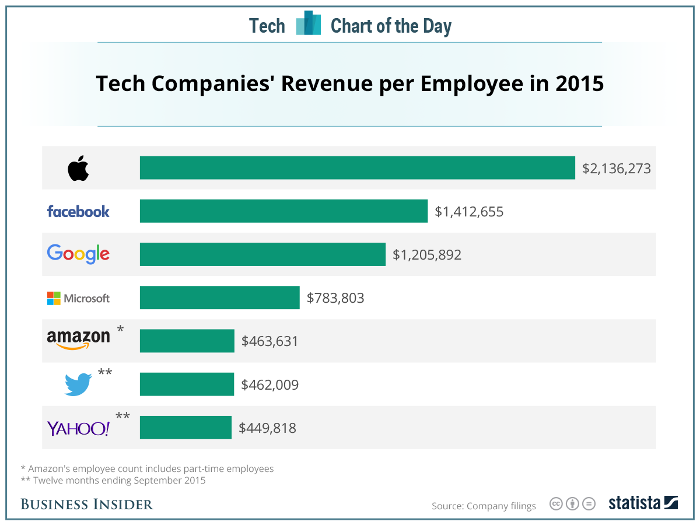

Finally, another metric used to assess the efficiency of a business, and one that is one of my favorites, is “Revenue Per Employee”. As the name reveals, it is calculated by dividing the company’s Revenue by the total number of employees.

This is a very useful metric because in the majority of the cases, payroll is the most costly component of revenue generation.

Again, comparison here is only meaningful within the same industry, but as you might have guessed, tech companies are the ones that shine.

For example, Apple, Facebook and Google, generate more than $1 Million per employee. That is just astonishing.

Due to its nature, an online business can scale tremendously requiring only a small amount of employees.

(Note: Apple is obviously not a pure online company, but generates a significant amount of its profits from online services.)

Examples of Measuring Business Efficiency

Now, let’s examine an example to better understand the concepts. Suppose two fictional companies (in the same industry) with the following characteristics:

| Company A | Company B | |

|---|---|---|

| Revenue | 17,000,000 | 6,000,000 |

| Profitt | 1,200,000 | – 700,000 |

| Employees | 120 | 100 |

From a quick glance, it is fairly obvious which one is the most efficient, and therefore more profitable and valuable. Let’s delve into the details.

Company A generates $17 Million in annual revenue having 120 employees in total, for a very respectable figure of Revenue per Employee at around $142,000.

On the other hand, Company B generates $6 Million in annual revenue while employing 100 people, for a meager $60,000 Revenue per Employee.

As you can see, Company A is almost 2.5 times more efficient based on those numbers, and it achieves profitability at a profit margin of around 7%, whereas Company B struggles, posting a loss of $700K.

Additionally, assuming an average annual salary of $45K, and since an employee can cost around 1.3 times the base salary, we get to an annual cost of $58.5K per employee.

This means that Company B barely covers its payroll costs and needs to seriously reevaluate its business model, and perhaps perform a business restructure.

Causes of Business Inefficiency

Now, you might wonder how such a discrepancy occurred and what are the causes of business inefficiency.

Leaving edge cases aside (e.g. scaling the company prematurely), the root cause is probably multifold.

Perhaps Company B lacks the internal processes and procedures that are necessary to streamline operations.

Or it might have failed to invest in technology and now lacks the necessary infrastructure.

Or maybe it has a bad company culture and thus repels capable people.

Or perhaps it has not provided the necessary training to its employees who now fall behind the competition in technical knowledge.

Conclusion

Business efficiency is a concept that every business owner should understand and monitor. It can be measured in various ways, like calculating profit margins, return on investment ratios and revenue per employee.

Improving business efficiency is a long term game and it is all about the details.

By improving your company just a bit every single day, you are going to eventually build a well oiled machine that generates revenue requiring only the tiniest amount of resources.

Tracking the efficiency of your business, along with its other financial metrics, is critical when building and scaling your business, and it is a powerful weapon that can be used to beat your competitors. Do not neglect it!