Why Cash Conversion Cycle Matters for Your Business

Cashflow is the bloodline of your business.

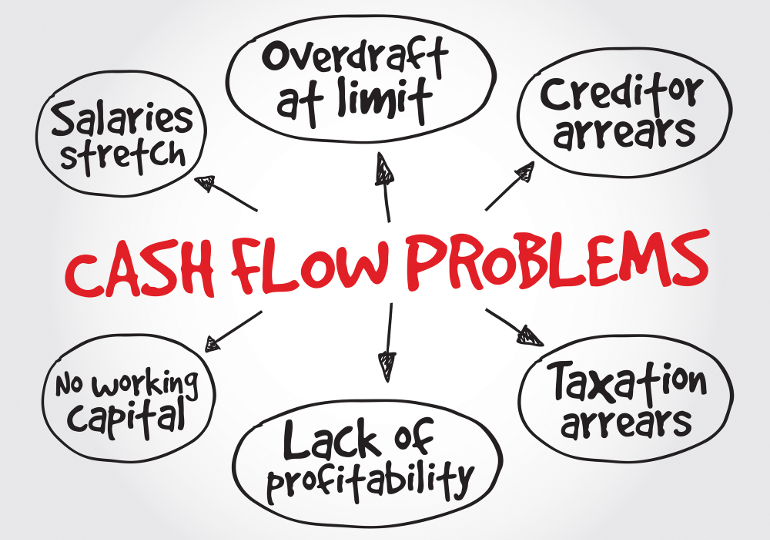

Without adequate cashflow, operations halt and companies flirt with bankruptcy.

As the old adage goes:

Revenue is Vanity. Profit is Sanity. Cash is Reality.

Given its importance, you would expect entrepreneurs to cautiously track and monitor their incoming and outgoing flows of cash.

Well, the elite businesspeople do meticulously track them, but the average business owner usually remains in the dark.

In this article, I am going to discuss a financial metric that is a bit obscure, but very critical at the same time.

Let’s get right into it.

Want to get my eBook "From Employee to Online Entrepreneur" as a nice PDF? Download it below!

What is Cash Conversion Cycle?

Cash Conversion Cycle (CCC) is a metric that expresses the length of time (measured in days) that it takes for a company to convert input resources into actual cash flows.

The purpose of CCC is to measure the amount of time that each input dollar is tied up in the production and sales process before it is converted into cash through sales to end customers.

It takes under account the time needed to sell inventory or services and collect receivables, thus completing the sales cycle.

The CCC is a combination of several activity ratios involving accounts receivable, accounts payable and inventory turnover.

Inventory turnover is a ratio showing how many times a company’s inventory is sold and replaced over a period of time. It measures how fast a company is selling inventory. A low figure implies weak sales while a high ratio implies either strong sales and/or large discounts.

The formula for calculating CCC is the following:

CCC = DIO + DSO – DPO

Days Inventory Outstanding (DIO) refers to the number of days it takes to sell an entire inventory (smaller figure preferred). Days Sales Outstanding (DSO) refers to the number of days needed to collect on sales, or accounts receivable (smaller figure preferred). Days Payable Outstanding (DPO) refers to the company’s payment of its own bills, or accounts payable (larger figure preferred).

Overall, we wish to have a Cash Conversion Cycle as short as possible (even with a negative value) via a combination of short inventory turnaround period, short accounts receivable period and long accounts payable period.

Put simply, we wish to sell as much product as possible in a certain timeframe, while collecting the cash from sales as soon as possible and paying our vendors as late as possible. Common sense, isn’t it?

Why Cash Conversion Cycle matters?

The cash conversion cycle is used to gauge the effectiveness and efficiency of a company and consequently, the overall health of that company.

The calculation measures how fast a company can convert cash on hand into inventory and accounts payable, through sales and accounts receivable, and then back into cash. The shorter this metric, the better for a company.

The metric is useful for companies in any industry, but is extremely important for retailers and similar businesses. The reason is that their operations consist of buying inventories and selling them to customers, which causes a large portion of their capital to be tied up as goods.

A particular case of cash cycle arises for online retailers. Since online retailers can pay their suppliers for goods after they receive payment for those goods from their own customers, they don’t need to hold as much inventory in house.

Combined with the fact that they are still able to hold onto that cash for a longer period of time, they often actually wind up with a negative CCC! Another reason to love online businesses.

For example, Amazon was found to have a Days Inventory Outstanding of 38.15 (turns inventory around very fast), a Days Sales Outstanding of 20.96 (collects cash in less than a month) and a Days Payables Outstanding of 118.06, for a value of -58.95 (38.15+20.96-118.06).

This allows Amazon to grow insanely fast by leveraging the capital of its vendors. That makes Amazon an amazing company. But you already knew that!

Why is Cash Conversion Cycle important to a business?

As I mentioned above, CCC is a metric that gauges the efficiency of a business and it is extremely critical.

The reason is because the faster an invested dollar is recouped, the sooner the business can invest it again in marketing, lead generation, sales and human resources.

Let’s assume two companies in the same industry with two different CCC profiles. Company A has a Short Cycle of 45 days, while Company B has a Long Cycle of 90 days.

For example, this might happen because Company A has more efficient operations or because it has negotiated better terms with its vendors.

In the case of the Short Cycle, the business can buy $1 worth of marketing spend every 45 days, thus generating sales much faster. In the Long Cycle, the business must wait three months before investing that dollar.

It is obvious that Company A is going to grow much faster than its counterpart. Not only that, the Long Cycle company will need to acquire additional capital in order to fund its operations, something that can be very costly.

How to think about Cash Conversion Cycle in your business?

These all sounds nice and neat, but how can you take advantage of your knowledge about CCC?

Well, you need to structure your operations in a way that your CCC is as lows as possible, or even turns negative.

In order to achieve that, you will have to sell your product or service as soon as possible. At the same time, you will need to press on your customers to collect payments as early as possible leaving only a small amount of accounts receivable. Finally, you will need to arrange with your suppliers and vendors so that you pay them as late as possible.

Bear in mind that B2C companies are, in general, more favored in this area, since they can collect money from their customers up front and pay their suppliers down the road.

As a final note, you should take Cash Conversion Cycle into consideration when evaluating different business ventures that you would like to pursue.

A business model that sports a low (or even negative) CCC will allow your business to grow and hit scale much faster and it will be an extra point in comparison to a model with long CCC.

Conclusion

Cash Conversion Cycle is a useful, yet underappreciated, metric that shows you how efficient your business is.

By tracking it, along with your cashflow, you will be able to understand how quickly you are turning one dollar into sales, and back into cash.

A shorter CCC will allow your business to grow faster, so make sure to take the necessary steps to decrease it whenever possible.

And don’t forget. Keep those dollars rolling!